This post will show you 10 best apple pay alternatives that you have never witnessed before. Mobile payment apps have grown in popularity as cash usage gradually disappears and individuals are discouraged from touching credit card readers due to health reasons. By using these apps, customers can make purchases of goods and services both from home and in physical stores.

Although there are several apps for mobile payments, Apple Pay is one of the most well-known. Apple Pay is an amazing mobile payment and digital wallet service that the company provides that enables users to pay at physical locations, through iOS apps, and online retailers.

The majority of iOS devices, including the iPad, iPhone, Apple Watch, and Mac, are supported; however, it is not supported on any hardware produced by Apple. Like most things, Apple Pay has some drawbacks, such as the fact that it only functions on Apple devices and requires a more involved setup process than rival services.

Users are continuously looking for alternatives to Apple Pay, the widely used payment method, as a result of these few drawbacks. This post lists the top 10 alternatives to Apple Pay if you’re looking for a different payment method.

10 best Apple Pay Alternatives to Transfer Money

The top Apple Pay substitutes are listed below.

1.PayPal

One of the best widely used methods of mobile payment today is PayPal. The app is the most downloaded payment app on the Playstore, with over 400 million users globally. The platform actually offers users a wide range of fantastic payment advantages.

Users of Paypal don’t need to carry cards everywhere because the platform offers Touch-free payments, which let you buy almost anything using just your smartphone. Millions of supported firms, like Hulu, Spotify, green hub, etc., accept payments from users.

According to the exchange rate in your country, Paypal has a brand-new payment option called “Check out with Crypto” that enables customers to spend cryptocurrency at a variety of online retailers. Users of the platform can also purchase credit services and divide their payments into four interest-free instalments.

2.Google Pay

Another top Apple Pay substitute is Google Pay, formerly known as Android Pay. The service was created by Google to support contactless payments on smartphones. Users may use Android watches, tablets, and phones to make payments, just like Apple Pay. With some restrictions, Google permits iOS users in the US and India to access the service.

It enables users to upload their payment information in their Google Pay wallets, which takes the role of credit or debit cards at POS terminals. With more than 227 million users worldwide, Google Pay is extremely well-liked. Users can easily enter payment source information by taking pictures of their cards.

Users are able to utilize Paypal to finance their Google Pay accounts. To validate your purchase, all you have to do is unlock your phone thanks to the user-friendly UI. To confirm payments, you don’t even have to open the app. Users can use Google Pay on their smartphones as well as some very expensive timepieces from brands like Louis Vuitton, Tag Heuer, and others.

3.Samsung Pay

One of the most cutting-edge payment apps available today, Samsung Pay easily competes with well-known programs like Apple and Google Pay. One of the first payment apps to offer a customer rewards program, it was also the first to support payments via magnetic credit card terminals without NFC technology.

The app works on a Samsung Watch in addition to the Galaxy S6 and the majority of the most recent Samsung smartphones. On a Samsung watch, the app has an integrated security feature that asks you to input your pin once you take the watch off to make sure someone didn’t just take it and start making purchases.

Users may also take advantage of employee pricing thanks to this app, which offers discounts of 30% on all significant Samsung products. Every time you pay with this app, you receive 5 Samsung reward points. After accumulating 2,000 points, you receive a free $5 reward card, which isn’t much.

The main drawback of Samsung Pay is that you cannot use it to send money to your pals because peer-to-peer payments are not supported.

4. Zelle

Another top Apple Pay substitute is Zelle. Users can quickly transfer money directly from one account to another using this mobile peer-to-peer software. Because you don’t need to know the recipient’s bank account information, the platform makes payments simple.

Although Zelle is free to use and has no transaction costs, it is advised that you contact the bank to make sure there aren’t any hidden fees. Since Zelle doesn’t keep any of your personal information on file, the app is also incredibly safe.

Since Zelle was developed by some of the best institutions, your bank applications may not even require you to download it as a separate app because it interacts so seamlessly with them. Users are allowed to share payments with friends and family and send and receive unlimited cash.

5.Cash App

Although Square Inc. created Cash App in 2013, the platform also serves as a peer-to-peer payment software. Cash App is mostly known as an investment or trading app. Users may send or receive payments with just a few clicks using the app, which is accessible on both iOS and Android devices.

Cash App, like the majority of the other payment applications on this list, doesn’t require users to know the bank details in order to make a payment; just an email address or phone number will do. Before customers can withdraw money to their bank accounts, payments are first deposited into their Cash App accounts.

You can ask for a Cash App Cash Card to utilize your Cash App funds to make purchases at merchants and ATMs if you don’t want to transfer to your bank account.

6.Payoneer

Users can also send and receive payments via Payoneer, a payment service provider. It works quite similarly to Paypal and is a well-liked choice for independent contractors like Upwork and online retailers like Airbnb.

Users of Payoneer may take advantage of a ton of helpful tools, including currency conversions and international payments that facilitate transactions in more than 150 nations. Along with tax management tools, a prepaid debit card you can use at nearby ATMs, and an API that makes recurring payments easier, the service offers users other benefits. The mobile app is accessible via a web site, iOS, and Android devices.

7.Amazon Pay

Using their Amazon account credentials, Amazon users can make purchases on eCommerce websites through the online payment service known as Amazon Pay. Popular websites like Shopify, Magento, BigCommerce, etc. support it. The service is primarily made to speed up the checkout process for online buying.

You only pay per transaction with the app, which accepts payments in all major currencies. There are no setup or ongoing fees. The majority of Amazon Pay’s features are targeted at retailers, however the system still provides some basic customer features.

Customers, for instance, can place and follow orders with Alexa voice integration. The Amazon Pay button makes it simple for them to complete their online purchases by automatically filling in all of their payment details.

8. Venmo

A peer-to-peer payment program called Venmo enables users to send and receive money directly between people. The app is fairly user-friendly, and you can start making payments right away after installing it and connecting your credit and debit cards. Venmo payments remain in the app before being sent to the customer’s bank, just like CashApp payments do.

Typically, transactions between two Venmo users happen fairly quickly. However, when external banks are involved, the procedure becomes challenging. It could take upto three to five business days for funds sent from your bank to your Venmo account to appear, and vice versa.

However, Venmo offers an instant transfer option that costs 1.5 percent and can take up to 30 minutes to complete the transaction if you’d like to finish it quickly.

9.Stripe

One of the most economical and adaptable payment options is Stripe. It is an online credit card processor that is mostly used to run different types of online businesses. People looking for a variety of payment ways without a setup or monthly cost should definitely consider it.

Stripe seamlessly interacts with a variety of payment options, including digital wallets like Google Pay, Alipay, Apple Pay, and credit card networks like Visa and American Express. The program works great for internet businesses, but it is less useful for those who primarily accept payments in person.

Businesses can take advantage of Stripe’s powerful API integration features, which let developers create completely unique payment gateways for their online storefronts.

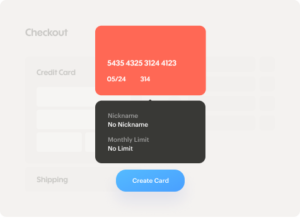

10.Privacy.com

One of the safest payment apps accessible is Privacy.com. It enables users to design unique virtual credit cards right in their browser for one-time purchases or subscriptions. It’s ideal for people who don’t want to constantly give their credit card information to every website they visit.

Users have the option to close any card at any moment and establish spending restrictions. The platform is actually very simple to use, and it even provides a browser extension so users can quickly fill out all of their payment information. If you wish to reduce your expenditure, you can use the spending limit function.

Even when you have money in your bank, if a transaction exceeds the spending restriction that has been set, it will immediately be declined. You may easily monitor your account by tracking your expenditure from your dashboard in addition to the spending limit option.

Conclusion

Despite having many wonderful features and advantages, Apple Pay nevertheless has a few drawbacks. Fortunately, our post has compiled a list of the top 10 Apple Pay substitutes. Both iOS and Android smartphones can use all of these apps.