Looking for cash app alternatives? This post will show you 13 best cash app alternatives that you have never witnessed before. Online transactions are actually part of everyday life in the modern world. Most people now send money to friends and family all around the world on a daily basis in addition to making purchases online.

At the time of this specific writing, there were more than 36 million active users of the well-known mobile banking app Cash App. It enables people to send money rapidly amongst one other using the mobile app on their smartphones or tablets.

In addition to other mobile banking functions, the handy Cash App lets users purchase and sell stocks or Bitcoin. It does, however, have some disadvantages. For instance, there are many unfavorable ratings of this business on TrustPilot and customers can only send and receive up to $1,000 in a 30-day period (unless you fully authenticate your account).

You cannot accept payments from customers outside of the United States and the United Kingdom because it is only accessible to users in those two countries.

As a peer-to-peer money transfer app, Cash App is not your only choice, even though it can be an excellent substitute for some people. This article will go through 13 of the greatest peer-to-peer money transfer and mobile banking alternatives to Cash App.

13 Best Cash App Alternatives to Transfer Money

Please notice that there is no particular order to the list below.

1. Wise (Former TransferWise)

The goal of the payment app Wise—which has desktop and smartphone versions—is to make international money transfers as affordable as possible. The software is currently accessible in more than 200 nations and is compatible with both Google Pay and Apple Pay (i.e you can add your Wise Card to both Google and Apple Pay service for making purchases).

Lower fees are incurred since international transfers are carried out using the genuine exchange rate rather than the markup rate imposed by the majority of banks. The biggest benefit of utilizing Wise is transparent pricing. The costs are shown to you before you send the transfer.

One drawback for customers who rely on online banking systems like PayPal is that you can only send money to recipients who have bank accounts.

2.PayPal

One of the most amazing popular online banking services is still PayPal. Using a PayPal account, users can send, receive, and keep money. You can send money to bank accounts and make online purchases in addition to sending money to other PayPal members. You can buy from practically any online retailer because PayPal is accepted by the majority of online payment processing platforms.

PayPal also performs automatic currency conversion. PayPal levies a fee when you receive money, despite the fact that sending money is free. PayPal is a target for frauds and phishing assaults due to its popularity. However, PayPal is one of the safest and most user-friendly payment methods.

Even though it is a fantastic option to any banking app, be mindful of the costs as they can quickly pile up.

3. Venmo

PayPal is the owner and operator of the mobile app Venmo. It is a mobile-only service accessible on Android and iOS devices, unlike PayPal. You can also add money to the Venmo balance and start sending and receiving money once you’ve linked a bank account.

While Venmo and PayPal have many similar functions, Venmo stands out due of its special social features. Users of the app can share and like transactions, and it has a social feed.

It was designed as a peer-to-peer (P2P) system for sharing money among close friends and relatives. You may use it, for instance, to reimburse a coworker who paid for your lunch or to split the expense of a supper with pals. It offers quick transactions and is simple to use.

4. Zelle

With Zelle, you may transmit money between practically any US bank account rapidly. The majority of transactions may be finished in a matter of minutes with just a phone number and email address.

Only US bank accounts are supported by Zelle, and credit card transfers are not supported. Similar to Venmo, Zelle focuses primarily on peer-to-peer (P2P) payments. Other Zelle users can send you money or receive it from you.

There are no transfer fees or restrictions on the amount you can receive with Zelle. On both iOS and Android smartphones, the software is accessible.

5.Google Pay

A mobile wallet and payment system created by Google is called Google Pay. After adding money from a linked bank account, the app enables users to request, send, receive, and withdraw money from their digital wallets.

Users can use Google Pay, like PayPal, to make purchases from practically any significant online merchant. Users of Google Pay can use the app at millions of physical stores that accept NFC payment methods in addition to shopping online.

Additionally, you can execute peer-to-peer money transfers using Google Pay between friends or a group of friends if you need to, for instance, divide expenses. High levels of security and a simple user interface are provided by Google Pay, allowing for quick transactions. Unfortunately, it’s only accessible in a small number of nations, which may not be practical for people who do business internationally.

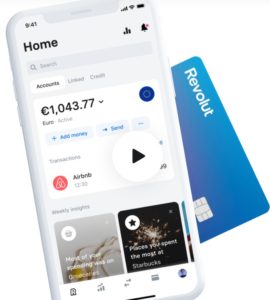

6.Revolut

A financial app called Revolut offers a number of supplementary services, including optional credit cards. For safe travel spending, you can also ask for a debit card with a predetermined spending limit. P2P transfers are possible with Revolut, making it simple to split expenses with friends or family.

The software has a budget planner that lets you keep track of where your money goes each month. Creating junior accounts for kids can also assist parents teach them the value of setting aside money and making financial plans.

Other benefits include the option to buy cryptocurrencies and seamless currency conversions when transferring foreign currencies.

7.Payoneer

Many of the functions found in PayPal are also found in Payoneer, which was created as a PayPal rival. You can send or receive money by connecting a bank account. A large variety of online shops and services in the US and Europe accept the app, which also facilitates international payments.

Owners of Payoneer accounts can furthermore ask for a Mastercard debit card. The card includes an annual fee but enables users to make in-store purchases and withdraw money from ATMs.

Payoneer typically has higher fees and fewer supported currencies than other payment processing systems. Additionally, payments must come from authorized organizations or other Payoneer users. The payments are nevertheless processed fast and securely.

8.Paysend

For people who need to send bigger sums of money, Paysend is an affordable payment transfer tool. Whatever the transfer size, the app charges a fixed cost of $2 for each transaction. A bank account or debit card or credit card, or money in your Paysend account can all be used to send money. Over a hundred nations presently use Paysend, which automatically converts currencies for transfers abroad.

Paysend charges a 0% exchange rate, in contrast to the majority of the Cash App substitutes. It is actually really one of the least expensive methods for sending money overseas because you only pay the flat transfer price. Paysend, however, involves a protracted review procedure. The approval process for new users frequently takes up to three days.

9.Xoom Money Transfer

With Xoom Money Transfer, you may send money to bank accounts, submit cash delivery, top up phones, and pay utility bills in different countries. It is made to accommodate practically all of your payment processing needs.

It is a practical choice for those who make payments automatically and for people who support relatives who live abroad. Due to PayPal’s ownership of Xoom Money Transfer, a high level of security is guaranteed. Over 160 nations support the app as well.

In comparison to other methods, the costs are somewhat high, particularly for minor transfers. The rapidity of delivery is Xoom Money Transfer’s key benefit. Depending on the recipient’s bank’s processing time, the majority of transactions only take a few minutes.

10.Facebook Pay

On Facebook, Instagram, WhatsApp, and Messenger, users can make purchases or send money using Facebook Pay. The system doesn’t come with a digital wallet. A linked bank account, credit card, or debit card is used to make payments.

Shopify and other online stores intend to implement Facebook Pay support. However, it is currently mostly utilized as a P2P money transfer system, making it simple for consumers to send money via social media to relatives or friends.

11.WorldRemit

Users of WorldRemit can send and receive money to more than 130 nations. The mobile software, which is accessible on Android and iOS devices, allows users to track payments and check their transaction history.

Even though WorldRemit levies transfer fees and a currency conversion margin, these prices are minimal when compared to those of some of the competing apps.

You can plan a cash pickup or a bank transfer when transferring money. A cash pickup allows the recipient to pick up the cash at a bank or retail location that has been authorized. The majority of cash pickups are finished in a matter of minutes, which is helpful for moving money abroad right away. The majority of bank transfers are finished the same day—roughly 90% of them.

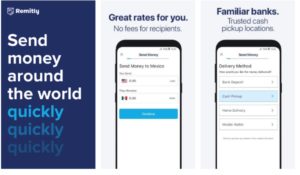

12. Remitly

Another money transfer service that lets you send or receive actual cash is Remitly. You can transfer money using your bank account for less expensive delivery or a debit or credit card for quicker delivery.

The normal electronic deposit can also be sent to the recipient’s bank account. Remitly provides more options for sending and receiving money, making it practical for people who prefer to pick up cash gratuitously (in addition to electronic transactions).

However, it is only authorized to send money from 17 countries (including United States, UK, Canada, Australia). You might need to utilize a different provider if you need to send or receive money abroad from more nations.

13.ACE Money Transfer

A money transfer service called ACE Money Transfer is accessible online and through mobile apps for iOS and Android devices. To users in more than 100 different countries, you can send money. But the software only accepts a few different currencies.

Users have the option of completing a transaction with a cash pickup, debit card, credit card, or bank transfer. ACE Money Transfer, on the other hand, is not a mobile wallet. The money must be transferred to a bank account or another mobile wallet provider, such PayPal. You can also set up a cash pickup so that your recipient can pick up the cash at a predetermined drop-off point.