Looking for venmo alternatives? This post will show you 10 best venmo alternatives that you have never witnessed before. Due to the simplicity it offers consumers, Venmo is one of the most used online payment systems today. The app is renowned for being particularly user-friendly and inexpensive. However, several aspects of Venmo’s system have also been criticized by users. For instance, Venmo’s anonymity is one of its weaknesses. Anybody using Venmo can see by default all user transactions on the platform.

The best news is that you may utilize a variety of Venmo substitutes in its place. The 10 platforms listed in this article provide simple online payment while safeguarding your financial information.

Describe Venmo.

Money can be sent and purchased online using the user-friendly online payment system Venmo. Users of the program can send and receive money from their pals. Venmo enables customers to shop online by partnering with well-known online retailers.

Your selected payment method can be quickly connected to the platform. Once your payment method is connected, you can send money to friends or make purchases online using your Venmo balance. You can also deposit money into the bank account using Venmo.

You may simply track purchases and split costs with Venmo friends using the Venmo card and app, both of which are provided by Venmo. You can also receive cashback and perks when you use the Venmo card.

Venmo has some drawbacks despite being practical. In addition to the fact that Venmo makes your transactions public by default, it also runs on the premise that payment senders and recipients can be trusted. As a result, neither buyers nor the sellers are protected by the platform.

Additionally, using the Venmo card costs $2.50 for each withdrawal. Additionally, you can only use the card at shops and ATMs in the United States. Additionally, you will need to pay $3 if you need to withdraw money from a financial institution that requires a signature. If you simply want to cash out, all of these costs can mount up.

The best news is that we have compiled a list of the top 10 Venmo substitutes available right now.

10 Venmo Substitutes to Process Money Quickly

1.Braintree Payments, Inc.

Braintree Payments, one of the most well-liked Venmo substitutes, provides a web-based payment solution for both individual and business customers. This online payment platform is especially helpful for companies because it provides both small and large companies with a wealth of security and reporting options.

You can send and receive payments via the software’s web dashboard and mobile app, in addition. You can also choose from a different wide range of payment options on the site, including PayPal, Apple Pay, and Google Pay. This adaptability is useful if you use ecommerce software. Also offering a straightforward pricing structure, Braintree charges 2.9 percent + $.30 for each transaction.

2.Skrill

Consider using Skrill if you’re seeking for Venmo alternatives that are ecommerce-focused. The platform makes it convenient for customers and online businesses by allowing consumers to manage all of their transactions through a single account. You may quickly add money to your Skrill wallet and make online purchases with Skrill. Rapid transfer services also guarantee that purchasers pay vendors right away.

The platform can be utilized for a wide range of online activities, including as trade, in-game purchases, and even betting, thanks to its global reach. Furthermore, it costs nothing to transmit or receive money. The cost for transactions involving currency exchange rates is, however, 3.9 percent.

Skrill offers a simple account administration system.

3.XE Money Transfer

XE Money Transfer began as a website that offered exchange rate data but has since evolved into one of the most trustworthy Venmo alternatives. Money transfers are permitted on the platform without cost. At rates cheaper than those provided by banks, you can send money to more than 130 different countries.

The possibilities of XE Money Transfer are also useful to businesses. The platform’s API features enable you to integrate the system for processing and distributing mass payments in addition to facilitating international payments. Additionally, you can completely personalize the app to fit your identity. Additionally, there are no fees associated with processing foreign exchange transactions or receiving money with XE Money Transfer.

4.ACE Money Transfer

The ACE Money Transfer platform handles money transactions every single day of the week, around-the-clock. Users may relax knowing that their money is secure because to the software’s utilization of the highest grade security standards. It also takes payments made with Visa, MasterCard, Swift, and Maestro for increased convenience. You can also send payments using your debit card. There is no upper limit on the amount of money that may be sent while using this option, which is a benefit.

Through its website, the platform offers transfer tracking. You may also get the ACE Money Transfer app from the Apple App Store or Google Play. These mobile applications can deliver immediate transfer status information and alerts regarding currency exchange rates. Additionally, the platform charges transaction fees that vary per nation.

5.OrbitRemit

An international money transfer service is OrbitRemit. The platform provides a straightforward method for sending money; all you need to do is enter the desired amount and select your preferred currency. OrbitRemit shows the recipient’s total cashable funds, less service charges and exchange rate costs. No matter how much money you transfer, there is also a set cost.

Before using OrbitRemit to send or receive money, you must first register an account. You can track foreign exchange rates and send money on the go using the platform’s mobile app for Android and iOS. The software also allows you to schedule transfers and save recipient information, both of which are fantastic advantages.

On the homepage of OrbitRemit, there is a clear international exchange rate.

6.Xoom

Working with PayPal, Xoom offers a safe way to send money without paying a lot of fees. The platform is more often used in Asian nations. To make sure that you and your recipient always know how much money to expect from the transfer, it makes sure that all costs and fees are transparent and up-front. The platform is simpler to utilize with accounting software thanks to this transparency. Transaction costs are normally determined by the type of transaction, your payment method, and the nation where the transfer is being sent.

The fact that Xoom offers multiple payment options is fantastic. You can even have the cash delivered right to the recipient’s door and send money directly to bank accounts. Transfers can be finished in a matter of minutes, and payouts can be retrieved from any place worldwide that has been approved by Xoom. The technology also distributes updates via SMS and email for users’ peace of mind.

7.Payoneer

Ecommerce vendors and service providers may easily request and receive payments for their goods and services using Payoneer. International commercial transactions are made easier by the platform. Users can sell their goods and services on international marketplaces and choose to be paid in the currency of their choice.

The platform has built-in facilities for asking payments, similar to accounting systems, so you can send invoices with just a few clicks. On the other hand, you can also easily utilize your Payoneer account to balance and send payments to vendors and contractors online. Money transfers between Payoneer users are free of charge for enhanced convenience.

8.Stripe

Stripe provides robust solutions for online money transfers and payments, particularly for businesses and online sellers. With smart payment pages, editable checkout forms, and automated invoicing, the software’s payments platform offers an all-in-one solution for online enterprises. The ability to accept payments from popular debit and credit cards will also be available.

Stripe is reachable from any device, whether it be a desktop or a mobile device, as it is a platform that stresses usability. Because Stripe’s security infrastructure encrypts credit card numbers and complies with the strictest industry standards, you also don’t need to worry about the safety of your data.

9.WePay

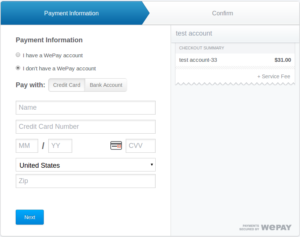

WePay, a JPMorgan Chase firm, enables online payments for a variety of individual users and business owners, including online vendors and independent contractors. The system also provides integrated POS platforms, marketplaces, and SMB payment solutions. WePay has a solution to make the online payments more practical no matter what your business model is.

For instance, WePay Link makes payment monetization simple. For merchants with Chase bank accounts, same-day deposits are free of charge. Additionally, you’ll be able to take payments made using debit, credit, or electronic checks. The platform also makes use of cutting-edge tools to facilitate transactions and thwart fraud. You can ensure that your money is safe with the help of these measures.

For a wide range of individual users and business owners, including internet retailers and independent contractors, WePay facilitates online payments.

10.PayPal

Last but not least, PayPal is a fantastic Venmo substitute. The platform provides a quick, safe way to transmit money to people or businesses. Individual PayPal users receive a digital wallet where they can store their bank accounts, credit cards, and debit cards. These features facilitate and speed up internet payments and money transfers.

PayPal provides similar round-the-clock fraud detection monitoring. As a result, if the system notices any unusual behavior in your account, it will notify you. This function enhances the security of both your bank account and digital wallet. All qualifying PayPal transactions are covered by the system’s Purchase Protection function. In cases when the feature is applicable, PayPal reimburses the full purchase price in addition to the original shipping fees.

Selecting the Best Venmo Replacement

As you can see, if you are looking for online payment services besides Venmo, you have plenty of options. Numerous internet payment systems provide more choices than only money transfers. Some online payment systems, like PayPal and Payoneer, provide capabilities that are useful to both enterprises and retailers.

Additionally, a lot of online payment methods provide comparable features and functionalities. Which platform offers the most value in terms of fees and charges without sacrificing speed and security is ultimately what matters.