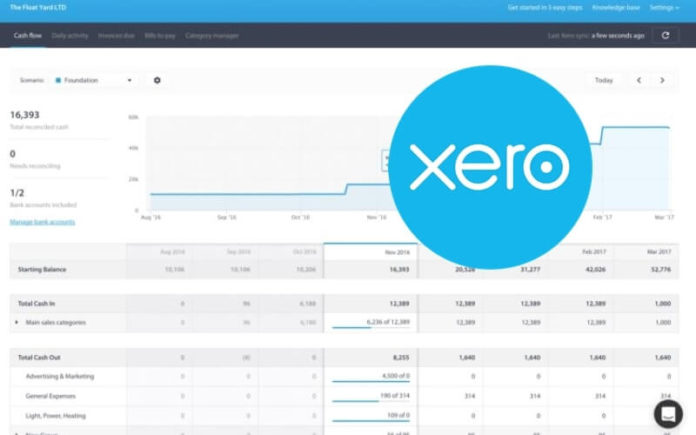

Are you also looking for xero alternatives? This post will show you 10+ xero alternatives that you never knew before. Xero is a fantastic small business accounting program, but it might not be perfect for you. Don’t worry; we’ve compiled a list of the best Xero alternatives for you to choose from.

Xero accounting software is one of the most extensively used accounting software programs for small businesses. Xero is the best accounting software for sole proprietors, freelancers, and small and developing enterprises, coming in second only to QuickBooks.

10+ Xero Alternatives that You Must Know

But what if you discover that Xero isn’t the correct accounting software for you? Don’t be concerned. There are a plethora of additional options available.

What to look for in Xero replacement

What features should you look for in accounting software? Invoicing made simple? Is the price reasonable? Perhaps you’re looking for a program that will grow with your company?

Whatever you’re looking for, one of the aforementioned apps is likely to have it. Take a closer look at the following features if you’re looking for a Xero replacement.

1. Creating invoices

Invoicing your clients is one of the most crucial things you’ll perform as a small business owner. Is it critical that your software allows you to customize an invoice?

Do you want your invoices to include payment links? Do you wish to levy late fees on invoices that are past due? Choosing which invoicing features are most important to you will simplify your software search.

2. Information gathering and reporting

Sole proprietors and freelancers may usually get by with modest reporting options, but if you need a lot of them, make sure to look into the reporting capabilities of any software you’re considering.

The simplest approach to do this is to have a look at a demo of the app and spend a few minutes looking at the reporting choices to make sure it contains everything you need.

3. Encouragement

Xero may not be for you if you require a lot of assistance when trying out a new software tool. It offers email help but no phone support, which can be inconvenient for individuals who prefer to talk to someone.

While it may not be at the top of your wish list, looking into the support choices for any software package you’re considering will help you avoid unpleasant surprises later.

The following are our top ten Xero alternatives.

While Xero is used by millions of business owners throughout the world, there are many other options. If Xero isn’t perfect for you, have a look at our top 10 Xero alternatives to find the best solution for your company right now.

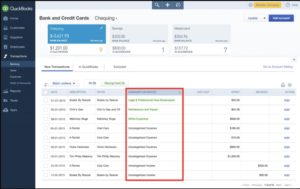

1.QuickBooks Online

QuickBooks Online was created with extremely small businesses in mind, but as the software has evolved, it has become a popular alternative for larger business owners.

Many of the capabilities you’re searching for are available in QuickBooks Online, including simple system setup, bank connectivity, and effective invoicing and cost management. A bank reconciliation option is also available in QuickBooks Online, making month-end reconciliation a breeze. Check this article on Intacct Alternatives.

QuickBooks Online has adequate reporting capabilities, and you can link with a variety of third-party apps if you require a capability not included in the software. With each new edition, the number of features available grows, so you may need to upgrade to a more expensive plan to receive the features you want.

QuickBooks Online currently has four plans: Simple Start, which supports a single user and costs $12 per month; Essentials, which costs $20 per month and supports three users; Plus, which costs $35 per month and supports up to five users; and Advanced, which costs $75 per month and supports up to 25 users.

2. Sage Cloud Accounting for Business

Freelancers, sole proprietors, and extremely tiny firms are best served by Sage Business Cloud Accounting. Sage Business Cloud Accounting is available in two options, each of which includes sales invoicing, payment tracking, and bank connectivity.

You may produce quotations and estimates for your customers and then convert them to invoices using Sage Business Cloud Accounting’s sales tool. The application also has good invoice customization possibilities, or you can simply use the application’s invoice templates. Check this article on SAP Alternatives.

Once you’ve created an invoice, you can quickly monitor it in Sage Business Cloud Accounting, which also allows you to handle stock, non-stock, and service items. You can also take online payments from clients and use ACH transfers to pay vendors.

Sage Business Cloud Accounting is an entry-level accounting program.

Although report customization is limited, and reports are not available in the low-cost subscription, contains good reporting tools.

Sage Business Cloud Accounting has two plans: Accounting Start, which is $10/month and contains basic functionality, and Accounting, which is $25/month and includes bill processing, quotes and estimates, and reporting options.

3. Zoho Books

Zoho Books is an intriguing program that’s especially well-suited to small enterprises. Zoho Books has a comprehensive range of capabilities, including inventory management and time tracking, which makes it a fantastic choice for selling items and services.

Zoho Books is especially useful for new business owners who aren’t familiar with accounting or bookkeeping. Check this article on Logmein Alternatives.

Customer and vendor administration, as well as estimates, sales orders, and recurring invoices and expenses, are all available through Zoho Books’ client interface.

It also interfaces with a variety of payment providers, making it simple for your clients to make online payments to you. A mobile app for both the iOS and Android devices is now available.

Many reports are available in Zoho Books, all of which are fully customisable and exportable to a variety of formats.

Microsoft Excel is a spreadsheet program.

Basic, which allows up to two users and is $9/month, Standard, which supports up to three users and is $19/month, and Professional, which supports up to ten users and is $29/month, are the three plans offered by Zoho Books.

4. OneUp

OneUp may be the most innovative accounting software you’ve never heard of. OneUp is a wonderful fit for sole proprietors, freelancers, and small enterprises since it provides excellent custom invoicing, handles customer estimates, and allows you to include a payment link with your invoices.

OneUp also offers an Opportunities feature that is great for service organizations to track their consumers, as well as an inventory management module that allows you to track inventories in several locations.

OneUp also provides strong reporting capabilities, with a number of reports such as purchase order and project reports, as well as full financial statements, available.

OneUp has five different plans to choose from:

$9/month for a single user on the Self plan.

The Pro plan, which supports two users, is as follows: $19/month

Three users are supported by the Plus plan: $29/month

The team plan, which may accommodate up to seven users, is as follows: $69/month

Infinite plan, which allows for an unlimited number of users: $169/month

One of the most significant advantages of utilizing OneUp is that you have instant access to all functions, regardless of the plan you select.

5. FreshBooks

FreshBooks continues to introduce new features on a regular basis, making it ideal for the self-employed and extremely small enterprises. A retainer option is available in FreshBooks, which is great for attorneys, accountants, and consultants who bill clients on a regular basis.

FreshBooks also has the option to collect online credit card payments from customers as well as ACH payments.

FreshBooks provides good client invoicing, expense tracking and recording, and payment posting. FreshBooks also has tools like time tracking, project management, and client estimates, as well as the ability to prepare a client proposal.

FreshBooks allows you to add team members to your plan, whether they’re workers, associates, or consultants, if you’re working with a group. FreshBooks’ reporting options are adequate, with reports like recurring revenue and retainer summary being particularly useful for consultants.

FreshBooks has four plans: Lite, which is $15 per month and is suited for sole entrepreneurs; Plus, which is $25 per month; Premium, which is $50 per month; and Select, which has pricing tailored to each user. FreshBooks offers software promotions on a regular basis, so check the website for the most up-to-date pricing.

6. QuickBooks Desktop

There’s a reason QuickBooks Desktop is still the most popular small company accounting software in the world. It includes everything a small business owner needs to run their company, such as reliable invoicing, inventory management, vendor management, and bill payment. QuickBooks Desktop is also scalable, with the ability to accommodate up to 25 system users, making it ideal for small and expanding organizations.

The availability of industry-specific editions of QuickBooks Desktop, tailored for small manufacturers, NGOs, and retail firms, is perhaps one of the most advantageous features of the application.

Another advantage is QuickBooks Desktop’s unrivaled reporting capabilities, which include over 100 standard reports as well as industry-specific reports when using a speciality edition of the software.

In addition, both the Premier and Enterprise editions of QuickBooks Desktop have forecasting capabilities, which is uncommon in a small business accounting software package.

QuickBooks Desktop has three plans: Pro, which covers up to three users and costs $299.95 per year; Premier, which costs $499.95 per year and supports up to five users; and Enterprise, which costs $1,091.70 per year and supports up to 30 users.

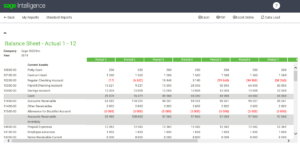

7. Sage 50cloud Accounting

Sage 50cloud Accounting, a close competitor to QuickBooks Desktop in terms of features and functionality, combines the stability of a desktop solution with the convenience of online access via Microsoft 365.

Customer management, invoicing and payment acceptance, automated bank feed, purchase orders, and sales tracking are just a few of the capabilities available in Sage 50cloud Accounting. The application also has bank reconciling capabilities.

Sage 50cloud Accounting, which is ideal for small and growing enterprises, also features efficient inventory management and solid reporting options, with over 100 reports accessible. In addition, the optional Intelligence Reporting add-on offers additional analytics-focused reporting options. Sage 50cloud Accounting’s top two plans additionally contain comprehensive budgeting and task costing features. Sage 50cloud Accounting is a scalable accounting program that is suited for developing companies.

There are three plans to choose from: Pro, which is a one-user system and costs $199.95 per year; Premium, which costs $299.95 per year and supports 1-5 users; and Quantum, which costs $399.95 per year and can handle up to 40 users, with custom pricing available directly from Sage.

8. AccountEdge Pro

If your company is expanding, you’ll need an application that not only meets your needs today, but also expands with it. If you’re encountering this problem, AccountEdge is a great option. It’s designed for sole proprietors, freelancers, and consultants, but it also has the scalability your company needs in the long run.

AccountEdge Pro provides a client portal for speedy invoice delivery and a web pay option for convenient invoice payment, as well as a plethora of other capabilities like as sales, time and billing, purchasing, inventory management, and banking.

A Contacts tool is also included in the app, which can be used to manage clients, vendors, and workers from an one spot. AccountEdge Pro has a lot of reporting capabilities, with a lot of reports in different categories. If needed, all reports can be altered or exported to Excel.

AccountEdge offers two on-premise plans: Basic, which costs $149 one-time, and Pro, which costs $399 one-time and includes the option of having the plan hosted remotely.

In addition, AccountEdge offers two cloud plans: Priority Zoom, which costs $50 per month, and Priority ERP, which costs $150 per month.

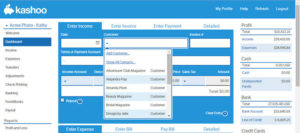

9. Kashoo

Kashoo is a cloud-based invoicing software designed for sole proprietors, consultants, freelancers, and extremely small businesses. It has typical invoicing features as well as the ability to establish a recurring invoice for customers that are billed monthly, which is a useful tool for consultants.

You can enter payment details from the same screen after the invoice has been paid. Kashoo also has good bill payment capabilities, including the ability to run checks to pay merchants, which many of its competitors lack.

Kashoo also provides list-based vendor and customer administration, as well as product management, albeit inventory management is limited to monitoring SKUs for products.

Kashoo’s reporting options are restricted, with only eight reports available, so if reports are crucial to you, you should consider other choices. One of Kashoo’s most appealing features is how simple it is to record income and expenses, which is especially useful if you don’t want to link your bank account.

Kashoo is an all-in-one app with a single package that costs $199 per year and allows for an infinite number of users.

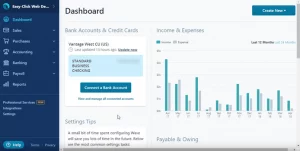

10. Wave Accounting

Wave Accounting is a free accounting program that is best suited for solo entrepreneurs, consultants, and freelancers. It is always free, regardless of how many users you have.

Wave’s freemium model hasn’t limited the number of services it offers, with estimating, sales, custom invoicing, bank connectivity, purchases, and bank reconciliation all integrated into one app. Wave also allows you to instantly upload expenditure receipts from your smartphone into the program, making it simple to keep track of business expenses.

Wave’s reporting capabilities are restricted, with only 12 reports accessible. Reports have limited customization options, but they can be exported as a CSV file for further customization. Any report can also be saved as a PDF, making it simple to share if necessary.

Wave Accounting is fully free, with only Wave Payments and Wave Payroll requiring payment. Wave Payments now charges a 2.9 percent + $.30 transaction fee, with an additional 1% fee for ACH payments.

Wave Payroll’s full-service payroll costs $35 plus $4 per active employee, with self-service costing $20 each month.

Which program is best for you?

Xero is one of the most popular accounting software programs on the market, but that doesn’t imply it’s the best fit for your company.

If you’re still not sure which app is best for you, read the complete evaluations of these Xero competitors, try out the demonstrations, and find the one that has everything you need to grow your small business.