Looking for best quickbooks alternatives? This post will show you 11 best quickbooks alternatives that you never knew before.

QuickBooks is basically the most widely used accounting software in the United States, with a range of functions ranging from budgeting to invoicing, payroll administration to spending tracking, contract management to financial reporting. However, it is not for everyone.

11 Best Quickbooks Alternatives You Must Know

QuickBooks’ ‘Swiss Army knife’ approach to accounting has a lot of small business owners feeling overwhelmed.

Most firms don’t require every accounting feature imaginable; they only require something to help them enter and categorize transactions, create a budget, and send invoices. These options are for you if you’re looking for something a little more user-friendly

1. Bench

Accounting is boring and distracting, and in an ideal world, someone else would take care of it all for you. Bench (that’s us) is a human-powered online bookkeeping service. Our straightforward service concentrates on bookkeeping and tax preparation, and we excel at it (see 4.7+ star reviews on Capterra and Trustpilot).

We’ll assign you a bookkeeping staff that will collect all of your company’s transactions, organise them for you, and provide you monthly financial statements. If the prospect of getting up on your bookkeeping, completing your taxes, or managing your finances on your own seems daunting, Bench may relieve you of that stress—for good. Check this article on Best Different Graphic Design Software

Do you want to have a fast look at your financial situation?

Your Bench account gives you a high-level picture of your company’s cash flow and expenses in real time, allowing you to understand where your money is going. Simply click into any transaction for more information.

Bench’s basic financial statements allow you to take a broader, long-term view of your financials after your transactions have been examined by your Bench bookkeeper.

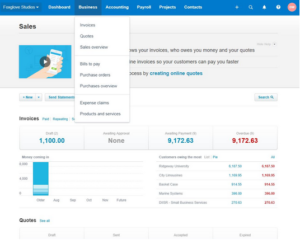

2. Xero

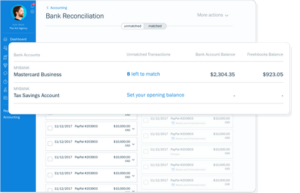

If you’re searching for a feature-for-feature substitute for QuickBooks in a more condensed, user-friendly form, Xero comes close. Xero allows you to access your money from any device with an internet connection, and it automatically imports all of your transactions. Read this article on Best Free Webinar Software Platform.

It also provides many of the financial reporting tools that make QuickBooks so appealing to you (and your accountant), without the feature overload. In comparison to similar programmes, Xero is also reasonably priced, starting at $12 per month and up to $65 per month depending on the options you choose.

Pros:

- Comprehensive accounting software including accounts payable and receivable, bank reconciliation, project budgeting, and reporting.

- Advanced accounting capabilities, such as asset management, fund accounting, and tax management • Small company and freelancer-friendly features, such as invoice management, purchase orders, expenditure monitoring, and payroll management

Cons:

- Does not have as many features and add-ons as QuickBooks • Isn’t as well-known among accountants • You still have to perform your own accounting

3. One Up

Consider One Up if you want a tool that can manage the nuts and bolts of accounting and recordkeeping without becoming bogged down in excess. One Up doesn’t do much, but it excels at the few things it does.

It’s all about helping you keep track of what you sell, charge your customers, and keep your numbers up to date. It is the only tool on our list that’s mobile-first and designed specifically for small businesses.

Pros:

- Small-business-focused suite of capabilities, including inventory management, invoice tracking, and an algorithm that categorises transactions for you • Mobile-friendly user interface • $9/month solo plan

Cons:

- Lacks features such as time tracking, payroll, and advanced reporting • “Unlimited” plan costs $169 per month • Becomes clogged when used by several people; no advanced authorization functions

- You’re still handling your own finances.

Time is a valuable commodity. Spend money on something else rather than performing your own bookkeeping. Allow the professionals at Bench to get your books up to IRS compliance and off your to-do list. Return valuable time to your business’s most important duties.

4. YNAB

You Need A Budget is the software for you if you primarily use QuickBooks for budgeting or are new to the concept of financial planning in general.

YNAB is simple to use, integrates with all of your bank and credit card accounts, and will walk you through making your first budget.

It is “the closest thing to having a positive-minded expert assist you in creating your own budgeting spreadsheet,” according to Wirecutter, and “the only budgeting app we’d spend our own money on.”

Pros:

- Comprehensive budgeting software, including goal tracking, reports, and advice

- Syncs consequently with most banks and credit cards, and makes it simple to sync manually with smaller institutions • Compatible with virtually every major operating system and browser

- Excellent technical and in-app support

Cons:

- It takes time to set up and get used to • It’s expensive ($84/year) when compared to other similar applications

- No support for numerous users

- You can’t keep track of your finances

5. Wave

If you prefer QuickBooks but don’t like the price, Wave is a good alternative.

It takes you around 75% of the way to your destination for free.

Wave helps you manage your receivables in a similar way to QuickBooks, allowing you to issue invoices, take payments, and keep track of any overdue accounts with crystal-clear data.

Wave, like QuickBooks, allows you manage your income and expenses, provides financial statements to help you remain on top of your financial health, and supports multiple users in case you need to let your accountant in on the action.

Advantages:

- Support for an unlimited number of users and enterprises

- Completely free accounting basics: receivables, revenue and spending tracking, financial reports, and payment management

Cons:

- No live phone support (only email) and sluggish support response times • You’re still doing everything yourself, with no support • You’re still doing everything yourself, with no support

6. GNU Cash

Don’t care for showy design?

Working with a group of programmers?

Do you want something free and open source?

Then GNUCash is the accounting and money management software for you. The power of GNUCash is that it allows you to do almost whatever you want with it. GNUCash undoubtedly already has the capabilities to do that, whether it’s budgeting, spending tracking, reporting, or double-entry accounting.

It’s also safe, devoid of malware, and the team behind it has been steadily adding new features since the project’s inception in 1997. GnuCash 3.5 can be downloaded here if you don’t want to spend money on an accounting product, want to support the open source community, and are prepared to learn GNU.

Pros:

- Full array of accounting and financial planning tools • Free • Open source • Mobile-friendly (including double-entry bookkeeping, budgeting, expense tracking, financial statements, etc.)

Cons:

- Intuitive • Long learning curve • Requires knowledge of double-entry accounting to utilise

See what it’s like to operate a business with Bench on your side.

Try us out for free—we’ll perform your bookkeeping for the previous month and generate a set of financial documents for you to retain.

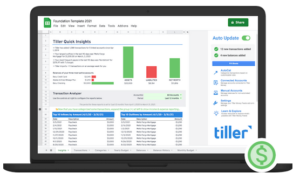

7. Google Sheets

Tiller can help if you’re tired of financial planning apps in general and just want to view all of your information in one spot on a spreadsheet.

Tiller imports all of your financial data, including bank accounts, credit cards, and investment accounts, into a Microsoft Excel or Google Sheets file.

After that, you can either create your own spreadsheets or use one of Tiller’s pre-made templates.

Tiller has a 30-day trial available here, and the full version is $79 per year.

Pros:

- Saves you time by automatically importing all of your data • Provides daily activity summaries

- Ideal for enterprises concerned about data security that do not want their data to be stored in the cloud.

- You’re still doing everything yourself • It’s not excellent for folks who don’t enjoy spreadsheets

8. New Excel Template

If you’re wondering what happened to good old-fashioned, manual-entry spreadsheet accounting, then you’ll appreciate our handy Excel template. It allows you to construct an Income Statement by setting up a simple single-entry accounting system, recording transactions, and doing basic computations.

Everyone have to do is enter all of your revenue, expense, and cost of sale categories, as well as all of your transactions, and the spreadsheet will take care of the rest. It’s ideal for someone who wants to start collecting basic financial data for their company but isn’t quite ready to invest in professional accounting software. Using an Excel Income Statement Template, you can do your own bookkeeping.

Fill in the blanks in this Excel template with your transactions, and you’re done! You will receive a ready-to-use Income Statement. Perfect for small business owners who don’t need full-fledged accounting software.

9. FreshBooks

FreshBooks may contain all of the accounting capabilities you need if you are a freelancer focused on invoicing users, keeping track of your work, and staying on top of your money.

FreshBooks covers the complete freelancer accounting pipeline, from the first hour you work and track with its time tracking features, to its smooth billing function that generates invoices automatically, to its ability to accept card payments from clients.

Do you want to remain on top of your bills?

FreshBooks allows you to set up automatic payment reminders, charge late fines, and even create repeating invoices automatically.

Really Want to take a step back and assess your company’s overall financial health?

FreshBooks can keep track of your expenses, generate income statements, balance sheets, and cash flow statements for you, and even generate activity reports that show you which projects are consuming the majority of your and your team’s time.

FreshBooks is a good accounting option for the average freelancer if you don’t need any of the advanced small business accounting features that QuickBooks offers, such as accounts payable, payroll, and inventory management.

Pros:

- Custom designs, recurring and scheduled payments functionality, and automatic payment reminders • Expense tracking and basic financial reporting • Advanced time tracking and reporting features

Cons:

- There is no bank or credit card reconciliation • There is no accounts payable, inventory, or payroll functionality • You are still doing everything yourself • Simple double-entry features are manual, which increases the risk of user error

10. Gusto

(It’s worth noting that Gusto isn’t accounting software; it’s solely for payroll.) Gusto can assist you if the idea of collecting and sending out tax forms, writing checks, keeping track of employee information, and taking care of direct deposits seems too much to handle.

They will actually walk you through every step of the payroll setup process, from entering employee data to linking your bank account to registering with the IRS.

11. Square

Square isn’t accounting software, as we should make clear right away. Look elsewhere if you’re looking for a business management suite that generates GAAP-compliant financial statements. However, some people do not require a full-fledged business management suite.

Some people simply want to know who purchased what and when. Square is for you if your business primarily processes card payments in-person in a retail setting, requires a few basic business tools such as inventory tracking and sales reports, and wants to seamlessly integrate with an ecommerce presence.

It’s designed for small retail and ecommerce businesses that are just getting started and need a low-cost, low-risk, straightforward solution with no hidden fees.

Square provides you with the necessary equipment, bundles it with software that supports mobile and ecommerce sales, provides you with basic reporting and inventory management tools, and charges you a percentage of each transaction (plus a small fee) to cover the costs. The standard processing fee is 2.6 percent plus a one-time fee of ten cents.

Pros:

- Easy to set up • No monthly or fixed fees • Works for online, retail, and mobile sales • Reliable and popular hardware/software solution

Cons:

- Unpredictable account freezes, slow support response times

- Fees per transaction are higher than those charged by other merchant processors • Accounting is difficult to manage