Looking for Payoneer Alternatives? Today, we’ll show you multiple payoneer alternatives that you have never witnessed before. Online payments present new issues for businesses. Payoneer is a good payment gateway, but there are other options. Include:

• Local and the international transactions • Money transfers • Send/receive payments between bank accounts • Low conversion fees

20+ Payoneer Alternatives for Swift International Transactions

1. PayPal

Since 2003, PayPal has dominated P2P and B2B financial services. PayPal is the frontrunner since it accepts all major payment forms immediately. Paypal is the top competitor of payoneer.

Pricing

Always free: PayPal. The $30/month plan has more robust features.

PayPal P2P, Payment Gateway, Fully Customized Online Checkouts

PayPal Not all online shops are integrated. Some money are delayed. Customer service is difficult to reach.

2.Square

Square Payments app securely processes payments swiftly. A business can take tap, dip, swipe, online, key-in, invoices, and appointments. Open APIs let you design custom solutions. No long-term contracts, extra fees, or surprises.

Pricing

Contactless, swiped, chip, and magstripe cards have a 2.6% + 10 cent processing fee. 3.5 percent + 15 cents for keyed-in payments.

Squares

• Free tools and hardware

No monthly costs, detailed reporting, and analytical filters

Square Weaknesses

• Processing fees are growing; you can’t easily switch accounts; instant deposit fees are exorbitant.

3.Google Pay

Google Pay is a fast, secure mobile payments app.

Pricing

There are no costs when using a debit card in a store or online. Credit card payments cost 2.9%.

Google Pay strengths

Easy integration with Google Assistant Digital wallet requires no physical card

Data-collection contactless payments

• Not accepted everywhere

• Data can be hijacked if the gadget is lost • Bank transfers can be slow

4. Tipalti

Tipalti streamlines payables automation. The end-to-end solution has built-in tax compliance in a unified cloud platform. The brand modernizes financial operations and provides a successful payment gateway. Tipalti provides white-label virtual payment services, AP automation, and digital marketplaces globally.

Pricing

Tipalti pricing is divided into two economical packages: Express and Pro. Express offers a cheaper, simpler payment alternative for teams. Pro includes W-8 tax forms or international tax IDs and multi-entity payables. Pro and Express cost varies by business needs, processing needs, and number of users.

Tipalti Advantages

• 360-degree view of the AP process • User-friendly dashboards • Automates financial processes to optimize operations and save 80% time

• Self-service supplier onboarding and tax compliance validation

Tipaltiweaknesses

• Some difficulty syncing specific integrations • Steep learning curve for reporting tool • Can’t update invoice data once processed, end-to-end payables.

5.Skrill

ACH transfers can fund Skrill accounts. Free. $5.50 per withdrawal. Debit card, Paysafecash, and ACH have no foreign costs. Credit card transfers cost 2.99%. Inactive accounts are charged $5 each month.

Skrill Strengths

• Omnichannel payment processing (ACH, e-commerce, mobile)

• Pre-built and configurable reporting and dashboards

Skrill Weaknesses

• Customers aren’t usually alerted during maintenance • User assistance can be overwhelmed • Phone apps can be limited

6.Remitly

Remitly is a mobile-based international payments company. Faster and cheaper than other international financial tools.

Pricing

Transfer speed, amount sent, and recipient’s country affect Remitly fees. Economy has lower rates and 3-5 day delivery. Express costs extra and takes a few minutes to deliver.

Remittances

Competitive transfer rates; fast, safe currency conversion; user-friendly interface

Remitly weaknesses

Money transfers can have limitations, take up to 15 minutes, and aren’t available in all countries.

7.Klarna

Klarna is a payment solution that saves businesses time and money. They offer financing, installments, and 30-day payments with zero fraud responsibility.

Pricing

Klarna charges 30 cents each transaction plus 3.29 or 5.99%. Klarna charges $30 per month for Instant Shopping, plus a 30-cent transaction fee and up to 3.29 percent (onsite sales) and 3.79 percent (offsite sales) in costs (offsite sales).

Klarna has a simple price structure and excellent customer service.

• Split or delay payments

Klarnaweaknesses

• Coverage limited

• Costlier than comparable platforms; 6-week payment plan

8. PaySimple

Conveniently accepts debit, credit, and cheques. Swipe it, set up recurring purchases, develop web payment forms, and more.

Pricing

PaySimple’s pricing strategy was designed for service-based businesses. 2.49 percent each transaction + monthly costs. ACH processing costs 69 cents plus 0.25 percent.

PaySimple advantages

• Personalized customer service • Easy approval procedure • Unified dashboard for management

PaySimple Weaknesses

• The company needs to grow and iron out kinks.

Can’t pay merchants with ACH

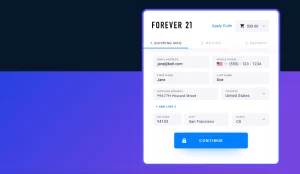

9.Bolt

Bolt aims to improve online companies’ checkout processes. Mobile-optimized technology and innovative fraud detection method speed up and improve order approval.

Pricing

Bolt creates individual bids for each firm, thus prices aren’t readily available. • Fraud risk • Sales volume • Business type

Bolts

• Fast checkout to enhance conversion rates • Fast mobile cart load times

Boltweaknesses

• Setup and integration can be difficult • The UI isn’t granular for transaction history

10.Apple Pay

Apple Pay allows businesses to make safe purchases in stores, apps, and online using any Apple device. Send and receive money via Messenger to streamline payments.

Pricing

Limited-time free Apple Pay for Apple users. Contact Apple for large-scale pricing. Small businesses say the platform is 36% cheaper than average payment gateways.

Apple Pay Strengths

• Easy to use and set up

• Security measures

Apple Pay Weaknesses

• Not globally accepted • Wallet app transactions can malfunction

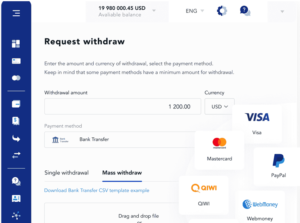

11. PayOp

A global internet payment platform. The system processes hundreds of currencies in 170 countries. This optimizes payment rates, reduces processing expenses, and eliminates linked fees.

Pricing

2.4% + 2c fixed charge. Over 300 online processing techniques mean prices vary.

• Fast withdrawals (1-2 business days) • Top-notch Skype customer support • Good platform for high-risk sectors

Weaknesses • Overzealous risk team can shut accounts • Plugin integration issues • Payer’s bank banned transactions

12. Neteller

NETELLER lets U.S. shoppers to shop online safely. 100+ payment choices and different currency accounts. Businesses can benefit from high deposit acceptance rates.

Pricing

NETELLER offers many integrations for funding your account, thus prices vary. Average transaction processing cost is 2.5%.

Strengths

• Withdraw from any ATM in numerous countries • Opt for a Net+ prepaid or virtual card • Secure virtual wallet

Weaknesses

• Can have hidden fees based on third-party • Minimum transfer limit

13. Hyperwallet

Hyperwallet is a global payments solution for expanding businesses. They’re trusted by e-commerce and enterprise organizations and assist disperse funds efficiently. They are a lot more cost effective than payoneer.

Pricing

Hyperwallet has local affiliates. Pricing isn’t clear. Contact the third-party processor for pricing.

• User-friendly for all levels

Hyperwallet

Full-stack payout

Weaknesses • Outdated backend UX • Slow sales and setup • Costlier than other solutions

14. Thryv

Thryv helps small businesses manage time, get paid promptly, and communicate with clients. Thryv offers 24/7 business specialist support.

Pricing

Thryv’s pricing isn’t posted online. Similar services cost $10 to $20 per month for simple apps.

Thryv

• Upload and update data in minutes

• Centralizes all business hubs in one dashboard

Thryv Weaknesses

• Learning curve

• Limited software

• Can’t ship immediately from Thryv when an invoice is satisfied

15. Paysera

Paysera is a cheap, safe way to send/receive money online. Multi-currency accounts allow quick and easy bank transactions to multiple countries. Payserea is alot more cheap than payoneer.

Pricing

Currency and transfer speed affect cost. Paysera offers competitive currency rates, usually within 1%.

Paysera • No fee to transfer money across Paysera accounts • Contactless debit card linked to account

16. Authorize.net

• Verification process can be complex

• Card only issued for EEA (Europe)

• Daily ATM withdrawal limit

Authroize.net lets merchants accept credit cards and checks via websites, call centers, retail storefronts, MOTO, and mobile devices.

Pricing

Authorize.net costs $25 per month. 2.9% + 30 cents each transaction.

Authorize.net strengths • Multi-option payment search

High-functioning, secure system User-friendly interface

• Payments can really only be accessed for a limited time • Design style isn’t as enticing as other platforms • Increasing transaction limits can be difficult

17.Dwolla

Dwolla simplifies and scales company payments. The brand has direct ACH and API integration. You can quickly transfer payments compare to payoneer.

Pricing

Each Dwolla payment has a.5% fee. The cost is.01 cents to $5.

Dwolla has attentive and competent customer service, real-time analytics, and 3rd-party integrations with benefits.

• API can be complicated and over-designed

• Poor Java support

• Can’t accept checks

18.BlueSnap

BlueSnap is a B2C and B2B payment platform. This system comprises a payment gateway, a merchant account, and sophisticated features. All-in-one dashboard.

Pricing

2.9% + 30 cents each successful BlueSnap transaction.

BlueSnap’s strengths include: integration with over 100 platforms and shopping carts, a built-in fraud stack, and robust reporting and analytics.

BlueSnap Weaknesses • Not all integrations are very seamless • Transaction reporting has a steep learning curve

19. Wise

Smart money transfer Wise provides consumer and corporate banking. The company platform provides payments and cash flow management. Wise Business integrates with QuickBooks. This is an amazing payoneer alternative.

Pricing

Wise’s business solution is 19 times cheaper than PayPal and 6 times cheaper than banks. Business account setup costs $31 and wire transactions cost $4.14. Non-wire transfers are free. Depending on the currency, sending money costs 0.41 percent.

Wise Strengths • Connects to Stripe and Amazon for withdrawals • Bulk payments accessible • Multiple currency support

Wise Weaknesses • Not a bank, thus no cash deposits • Some clients allege bad customer service and technical issues

20. WorldFirst

WorldFirst provides international commercial payments. They have Business and World accounts. Importers who pay overseas suppliers use a Business account, whereas e-commerce enterprises use a World account.

Pricing

WorldFirst’s pricing isn’t disclosed. Customers interested in more information should contact the company.

WorldFirst Strengths • E-commerce enterprises can collect several currencies in one account • Same-day payments for USD, EUR, and GBP

WorldFirst Weaknesses • Not available in U.S. • Some reviews mention hefty costs and delayed transfers

21.Stripe

Stripe designs e-commerce payment APIs. Its products allow 135 currencies and payment methods. Businesses can accept payments on their website or app by integrating Stripe’s API.

Stripe’s integrated solution costs 2.9% + $0.30. Companies can also choose a bespoke solution with varied pricing. Stripe Strengths Supports one-time and recurring payments No monthly fees Instant Payouts (for an additional fee)

Some clients complain excessive surcharge costs. Stripe doesn’t support high-risk businesses. You may need a software developer to integrate their service.

22.Adyen

Adyen is a fintech platform that lets businesses accept online and in-person payments. Other solutions include online-to-offline and embedded payments.

Pricing

Adyen charges a 10-cent transaction fee and a payment-method-specific fee. No monthly or setup fees.

• No closing, integration, setup, or monthly expenses

• Payment data from several sales channels • Integration flexibility

Adyen Weaknesses • Some clients report credit card integration issues • May not be suited for smaller enterprises

23.2Checkout

2Checkout’s payment solution accepts online and mobile payments in 200 countries. 100 currencies and 30 languages are supported. 2020: Verifone bought 2Checkout.

Pricing

2Checkout offers 2Sell, 2Subscribe, and 2Monetize. 2Subscribe charges 4.5 percent + 45 cents every successful transaction. Prices can be customized.

• Integrates with Shopify, Wix, and 120 other carts

PCI Level 1 certification for advanced security

2Weaknesses

• Trustpilot reviews say the help team is slow. • Doesn’t support in-store payment processing. • Some clients say the cart design is outdated.

24. ZenZen

ZenZen is a financial technology business that offers an online payment gateway and banking solutions like a multi-currency account. Zen’s relationship with Mastercard lets clients get real or digital cards and receive immediate payments.

Pricing

Zen has two accounts. One is a payment gateway with a bank account (25€/month), and the other is a business banking account (10€-500€/month). Other costs apply.

Zen Strengths

• Supports 20 payment methods • Plugin for easy integration

Zen Weaknesses • Not available to U.S. corporations.

13. Payoneer Mastercard alternatives

Payoneer is a debit and credit card that may send/receive local and international payments. Physical prepaid Mastercard linked to Payoneer account balance. The card can also be used anywhere in Mastercard is accepted (ATMs, retail, online). Payoneer has smart solutions for issuing prepaid cards.

1.NetSpend

NetSpend offers several financial management alternatives. They offer rapid, guaranteed Visa and Mastercard prepaid debit cards. Non-credit check. NetSpend cards cost $2.95 to $4.95. Reload fees average $3.95.

2. AMEX Serve

American Express Serve offers reloadable debit cards. It’s designed for diverse users’ needs. The system offers online and mobile transactions. Always free. Amex will waive the $6.95/month fee for $500 monthly deposits.

3.Business Bento

Bento helps SMBs manage employee expenses. The prepaid debit card can also be used anywhere Mastercard is accepted, with restrictions to limit categories, card usage, and daily budget.

Bento costs nothing for 2 cards. Extra costs:

Starter (10 cards) — $29/month; Team (25 cards) — $69/month; Professional (100 cards) — $149/month; Enterprise (above 100 cards) — bespoke price

4.MoneyCard Walmart

Walmart MoneyCard is a prepaid debit Mastercard or Visa used in-store or online to pay for rent, online bills, and products.

Free account with $500 monthly deposit. Otherwise, consumers pay $5.94/month.

5. Green Dot

Green Dot offers prepaid debit cards without a credit check. It offers 2% cashback and no limitations on mobile and web transactions. Free Green Dot card If you load $1,000 per month, the $7.95 cost is waived.

6.Prepaid PayPal

PayPal PrePaid is a PayPal-linked prepaid debit card. A firm can stock up, shop, and eat without carrying cash. Prepaid PayPal Mastercards cost $4.95/month. Other fees include ATM and bank fees.

7.Bluebird

Bluebird is a prepaid debit card that allows the user complete control. Bluebird is inexpensive. No activation or monthly fees. You only need to buy the $5 card.

8. MasterCard Prepaid/Digital Banking

Mastercard offers prepaid and digital cards. Prepaid cards don’t require credit checks or bank accounts. Link a Venmo or PayPal card to your account. Mastercard fees vary.

9.AccountNow

AccountNow is a prepaid Mastercard for folks who prefer cash. They can be used in-store or online. These cards can be used at ATMs for a fee. AccountNow costs vary by card. Fees and reloads vary.

10. ACE Elite

Prepaid Visa cards are handy and secure. Transfers and deposits add money. • Transaction alerts • Cash withdrawals • Card-to-card money transfers

ACE Elite Visa costs $15/month on average. ATM withdrawals cost $2.50 and pin purchases cost $2.

11.Revolut

Free, Grow ($39.99/month), Scale ($149.99/month), and Enterprise are Revolut card programs (custom pricing). You can store 28 currencies. Revolut quick transfers.

12. iPhone

Apple’s titanium credit card has no fees and lets people earn cash when shopping. The card uses biometric data (Face ID and Touch ID) to prevent fraud. The card links with the Wallet app, which shows your transaction history.

13.ZEN Mastercard

Zen Mastercard is beneficial for business owners who use its online payment gateway. It connects to Apple Pay and Google Pay and offers up to 15% cash back with Zen partners. Zen is free.